European Biopharma: Making the (Right) Move to Performance-Based Equity

- Published: July 2014

- Practice Areas: Equity Plan Design & Strategy, Life Sciences, Europe, Middle East & Africa

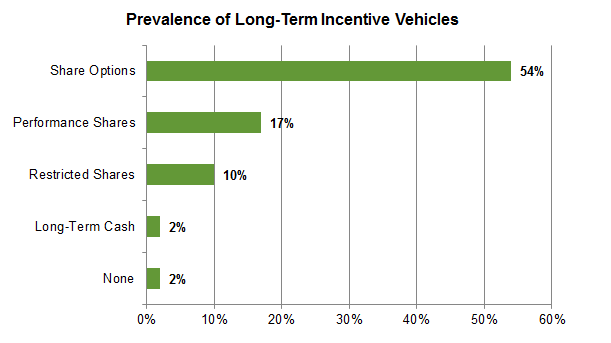

Share options remain the most prevalent form of equity incentive vehicle employed at small- to mid-size European biopharmaceutical firms. However, an increasing number of companies in this segment have introduced, or are considering, performance shares and/or share units. Moves of this nature need to be considered carefully. While performance share plans are "shareholder friendly" and can justify higher award levels, the choice of performance metrics is not easy. This is particularly true for pre-commercial or early stage commercial companies. At these firms, visibility into long-term performance can be murky.

The chart below illustrates equity practices for 30 European biopharmaceutical organizations defined by Radford as small- to mid-sized. They range in market capitalization from EUR 100 million to EUR 3.5 billion, with an average market cap of EUR 800 million.

Of the 30 companies included in our study, 11 firms operate at least one performance share plan (we actually identified a total of 18 plans at these companies), and most of these plans tend to use a single performance metric to govern vesting. In contrast, at big pharmaceutical companies in Europe, only 28% of plans use a single metric with most utilizing between two and four metrics.

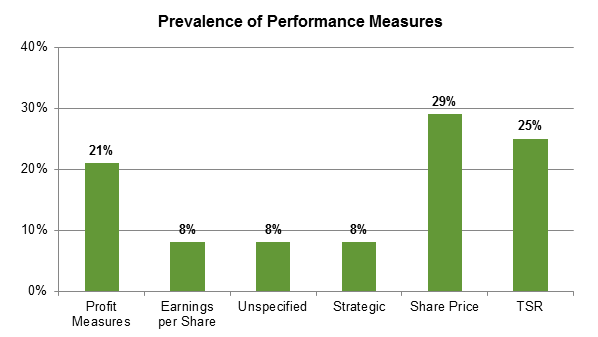

When considering performance metrics, most plan designs start with a fundamental choice: should market-based measures like relative total shareholder return (TSR) or operating metrics like R&D milestones be adopted?

Arguably, operating measures more closely align performance results with management decisions, but they can be much harder to set when performance is difficult to forecast, particularly for pre-commercial companies. The companies in our small- to mid-sized sample have a slight preference toward market-based measures: 56% use metrics related to share prices (including specific target prices, absolute TSR and relative TSR).

The chart below provides a breakdown of the metrics identified in our sample of 30 small- to mid-sized European biopharmaceutical organizations.

The results cited above differ from big pharmaceutical companies where close to a third of organizations use a combination of market-based and operating metrics. In this group, TSR is the most common metric followed by a wide variety of operating metrics such as cash flow, revenue, business milestones and return on assets (ROA).

Importantly, the final choice in performance metrics should not be dictated exclusively by market practice, but rather by what is right for your specific company. Metrics should take into account the ability of executives, and possibly broader employee levels, to influence performance outcome, as well as to what degree the organization can reasonably set long-term performance ranges.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles

- To Fuel Growth, Companies Make a Case for Using Inducement Grants More Often

- Will Today's Volatile Markets Bring Option Exchanges Back? What You Need to Know

- Down Rounds are on the Rise, Forcing Pre-IPO Firms to Explore New Retention Strategies

- Are Nordic Biotech Companies Under-Utilizing Equity in the Search for Top Executive Talent?

- The Link Between Employee Communication and Equity Plan Performance